Increasing private equity investments.

Nice article in Les Echos Capital Finance by Gabriel Nedelec on the increase in private equity investments.

https://lnkd.in/ev4f2hBC (summary of article below)

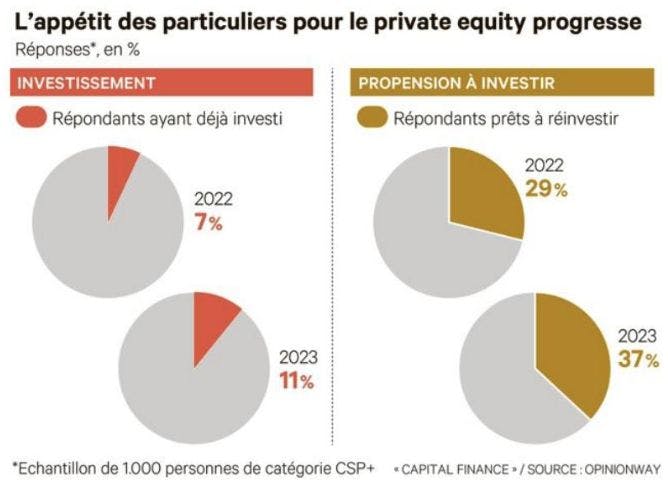

The proportion of people who have already invested has risen from 7% to 11% in 1 year, an increase of +50% over the last 12 months. Archinvest is supporting this trend by offering you the opportunity to invest in leading private equity funds.

The 2 multifunds Archinvest LBO 1 and Archinvest Dette Privée 1 are highly complementary and enable you to invest in leading international managers (respectively Bridgepoint, IK Partners, PAI Partners, EQT Group and Hayfin Capital Management LLP, Arcmont Asset Management, Kartesia). They will remain open until the fundraising target is reached, or until 12/31/2023 at the latest.

------

Summary of the Echos article:

Private equity is a fast-growing sector in Europe, with a record 85 billion euros to be raised by 2021. However, the sector remains little-known and inaccessible to individual investors, who account for less than 5% of investors in private equity funds.

According to the article, this is partly due to the complexity and high cost of private equity investment, which often requires high minimum investment amounts and significant management fees. In addition, private equity is a relatively unregulated sector, which can lead to significant downside risks for unsophisticated investors.

However, the article also points out that the situation is changing, with the emergence of new online investment platforms that are making it easier and cheaper for individual investors to access private equity funds. These platforms, such as Anaxago, WiSEED and Sowefund, offer lower entry fees, reduced management fees and greater transparency on investments made.

According to the article, this democratization of private equity is a fundamental trend that is set to continue in the years ahead, not least because of the search for high returns by retail investors in a low interest rate environment. However, the article also points out that this democratization must be accompanied by greater regulation and transparency on the risks and performance of private equity funds, to protect retail investors and boost confidence in the sector.

In conclusion, the article highlights the fact that private equity is a fast-growing sector in Europe, but one that remains little-known and inaccessible to individual investors. However, the emergence of new online investment platforms should enable a gradual democratization of this sector, against a backdrop of retail investors' search for high returns. This democratization must, however, be accompanied by greater regulation and transparency concerning the risks and performance of private equity funds.

------

Would you like to offer these opportunities to your customers and investors? Go to your manager space on www.archinvest.amouand contact our team at: contact@archinvest.am